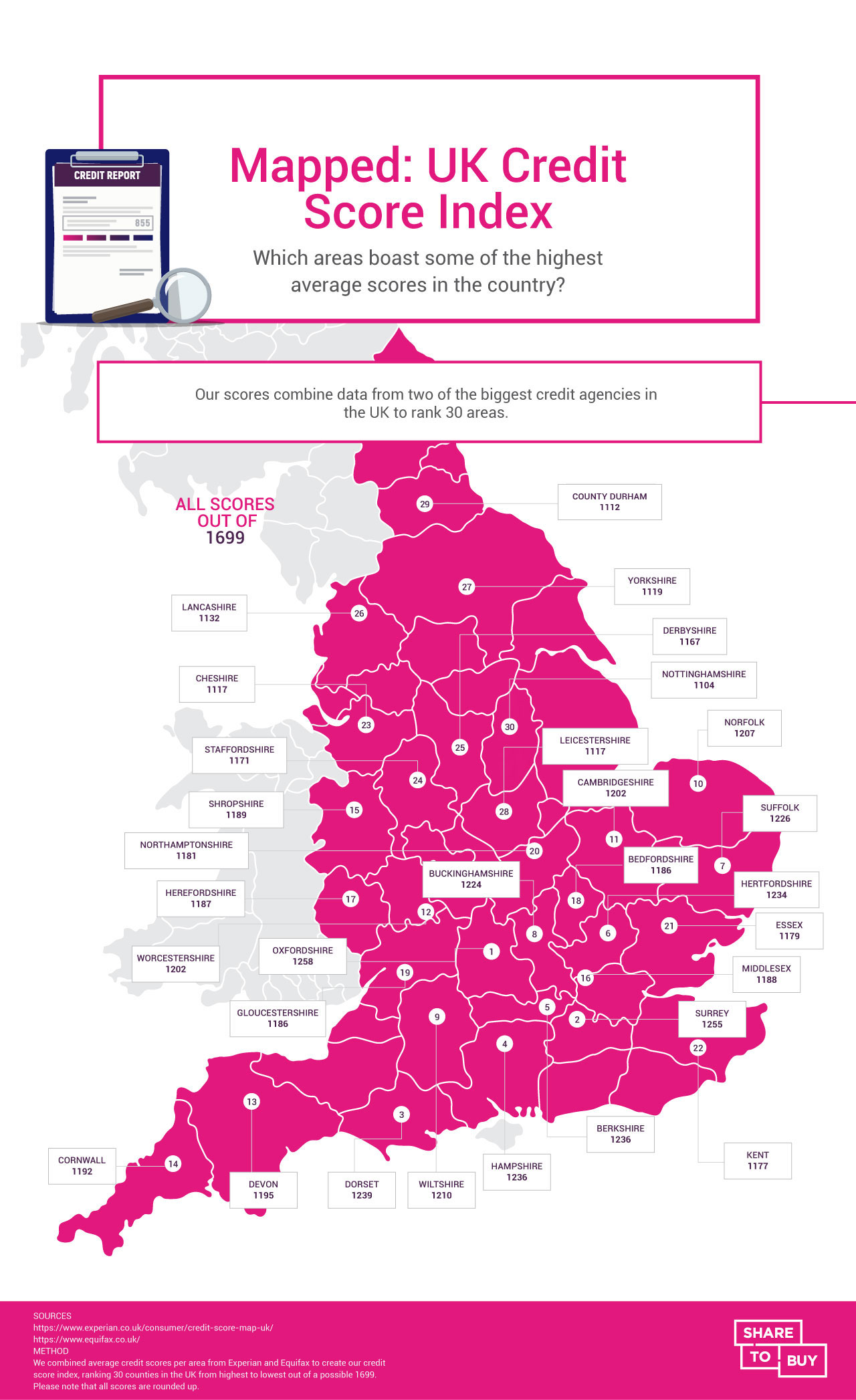

The south is home to eight of the top ten areas with the highest credit scores in the country according to new analysis by Share to Buy.

Using the latest data from two major credit agencies, Share to Buy have mapped out the UK’s average credit scores by county showing where the country’s best scorers live, and who currently tops the national average of 570.

According to Google search data, interest around loans peaked between March and June 2020, with the phrase ‘can I get a loan’ rose by 11% compared to the same period last year, while the phrase ‘how to improve credit score’ was up by almost 27% since 2019.

Top Five: Highest Credit Scores in the Country

Oxfordshire has the highest average credit score in the country, over two and a half times the national average of 570 and 154 points higher than Nottinghamshire, the area with the lowest credit scores in the UK.

| Highest Credit Score Areas | Total Score out of a possible 1699 | |

| 1 | Oxfordshire | 1258 |

| 2 | Surrey | 1255 |

| 3 | Dorset | 1239 |

| 4 | Hampshire | 1236 |

| 5 | Berkshire | 1236 |

Bottom Five: Lowest Credit Scores in the UK

All counties analysed have higher credit scores than the national average, but some areas in the UK lag behind their neighbours.

| Lowest Credit Score Areas | Total Score out of a possible 1699 | |

| 1 | Nottinghamshire | 1104 |

| 2 | County Durham | 1112 |

| 3 | Leicestershire | 1117 |

| 4 | Yorkshire | 1119 |

| 5 | Lancashire | 1132 |

What Impacts a Credit Score Positively

Several factors can impact credit scores throughout our lives. Registering to vote is an excellent place to start, as most credit scoring companies use this to help confirm your identity and address. Three ways to impact your Score positively include:

- Set up direct debits where possible: Consistent, regular payments look good on your profile, so try to set up direct debits for as many payments as you can to ensure you pay on time and in full regularly.

- Maintain older accounts: The average age of your bank account is taken into consideration by credit scorers, so try to stick to one account that can be well managed over the long-term.

- Don’t borrow more than you can afford: Always ensure you can meet minimum repayments easily, and pay off accounts sooner if you can. This shows you can manage within your set limits.

What Impacts a Credit Score Negatively

Credit scorers look for certain red flags when assessing your eligibility. Here are a few things you should try to avoid:

- Missing payments: If this happens regularly, you could have a potential default flagged on your profile, and this can stick around for up to six years.

- Lending beyond your means: Borrowing more than you can afford means sticking with repayments will be tricky, and when debt piles up, it can quickly become unmanageable. If you get a debt relief order or apply for bankruptcy, your credit score will be significantly impacted.

- Regularly applying for credit: Each time you apply for credit, lenders will perform a ‘hard’ search on your credit history, and this is logged on your profile. If too many of these are logged, it could become a possible red flag.

Commenting on their average credit score analysis, Nick Lieb, Head of Operations at Share to Buy says

“Many people have been asking us what constitutes a good credit score when trying to buy a home. The topic is more relevant than ever right now as we navigate our way through the uncertainty of the last few months, but with so many variables, and credit score companies all calculating scores differently, it’s not an easy question to answer.

We have combined data from two of the biggest agencies for our credit score review, and while it’s interesting to see the variation in numbers, average credit score is just one of several factors that play a part in your ability to get a mortgage. Therefore, even if your credit score is not where you want it to be, this shouldn’t be a deterrent in your search for a home”.

Notes for Editors

Methodology:

Share to Buy sourced average credit score data from Experian and Equifax for UK counties. Experian scores are out of 999 with an average UK credit score of 759, while Equifax scores are out of 700 with an average UK credit score of 380.

They combined data from both sites and ranked the scores from highest to lowest out of a possible 1699, averaging out overall scores for a national average of 570.

Please Note: All data correct at time of publication.

Homeowners Club If you are one of the 15 million homeowners in the UK, the free to join online Homeowners Club is for you.

Homeowners Club If you are one of the 15 million homeowners in the UK, the free to join online Homeowners Club is for you.