A report prepared by guest contributor Strata, an established home builder finds that over a lifetime rental costs will be over £1 million higher than the cost of buying, a 280% increase in spending.

Key findings include:

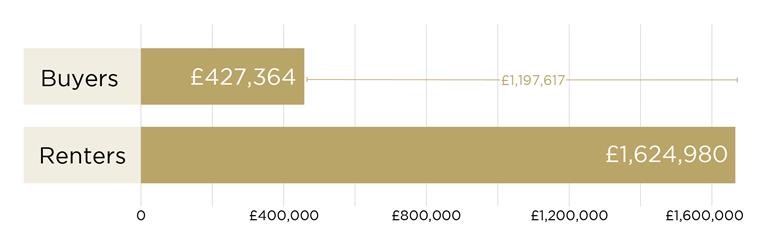

- The average spend for buyers is around £430,000, whilst lifetime renters will spend a total of £1.6 million

- Figures across the UK vary dramatically, with differences in London reaching almost £2 million, meanwhile the North East is at the lowest end of the scale with a variance of £720,000

- Lifetime renters in the North West will suffer the greatest indifference, spending 314% more than buyers in the same region

Renting for an entire lifetime will cost you £1 million more than purchasing your own home, according to research by new home builder Strata.

The research, which compares the cost of owning a home in the UK to average monthly rental payments over a 60-year period, proves that purchasing is significantly cheaper over the course of a lifetime.

According the Land Registry, the average first time buyer house costs £212,079, with a 16% deposit. With an estimated £4,800 of purchase fees and assuming buyers rent for an initial nine-year period, will spend around £430,000 (£427,363).

Meanwhile, lifetime renters will spend £909 a month on average on a lifetime home, which when adjusted for inflation, would reach a total of £1.6 million (£1,624,980) over a 60-year period.

That equates to a substantial difference of over £1.1 million (£1,197,616) with lifetime renters spending 280% more.

Figures across the UK vary dramatically, with differences in London reaching almost £2 million (£1,956,566) whilst the North East is at the lowest end of the scale with a variance of just over £720,000 (£721,095).

Lifetime renters in the North West will suffer the greatest indifference, spending 314% more than buyers in the same region.

The data was collected based on the assumptions that rental costs begin post university at the age of 21 and continue until the age of 81 – the average life expectancy for the UK.

Buyer figures are based on renting from the age of 21 until 30 – the average age of someone in the UK buying their first home*, and then obtaining a 25-year mortgage on a property worth just over £200,000.

The purchase figures also consider the outright costs incurred when buying, such as lender’s valuations, structural surveys and solicitor’s fees.

For all press enquiries please contact [email protected] / 0113 341 6612

About Strata:

Strata is an established home builder with developments across Yorkshire and the Midlands and head offices in Doncaster. Chief Executive Andrew Weaver is the fourth generation of the family to run the business alongside his father, Chairman Irving Weaver.

Homeowners Club If you are one of the 15 million homeowners in the UK, the free to join online Homeowners Club is for you.

Homeowners Club If you are one of the 15 million homeowners in the UK, the free to join online Homeowners Club is for you.